$dynamicTableOfContent

About Mortgage Email & Mailing Lists with Loan to Value Ratios

Mortgage Email & Mailing Lists & Loan to Value Ratios, help Mortgage related businesses connect with Homeowners based on how much Equity they have in their home.

What does Loan to Value Ratio mean?

The Loan to Value Ratio, according to Wikipedia, is “a financial term used by lenders to express the ratio of a loan to the value of an asset purchased.”

You can calculate your Loan to Value Ratio, by dividing your current mortgage balance by your current home value.

Here’s a great, quick 1.5 minute video by Investopedia, that explains Loan to Value Ratio:

Why is the Loan to Value Ratio important?

The Loan to Value Ratio is important, because it helps identify how much equity a homeowner has in their home and how much money they might be eligible to borrow.

Some people consider the Loan to Value Ratio as being one of many criteria, that can indicate Wealth.

What are Mortgage Mailing Lists with Loan to Value Ratios?

Some List Brokers can provide targeted Mortgage Mailing Lists

Mortgage Mailing Lists are marketing lists of Homeowners in any area of the USA who have a certain amount of Equity in their Home.

You can search for Homeowners who have a high or low Loan to Value Ratio:

- 0-10%

- 10-20%

- 20-30%

- 30-40%

- 40-50%

- 50-60%

- 60-70%

- 70-80%

- 80-90%

- 90+%

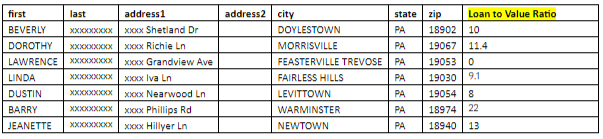

What do Mortgage Mailing Lists look like?

Here’s a sample Mortgage Mailing List in an Excel file format:

What information is included in a Mortgage Mailing List?

Mortgage Mailing Lists come in 3 easy-to-use List Formats. The most common format, is the Excel / CSV file format. The list includes the following information:

- First Name

- Last Name

- Title

- Address

- City

- State

- Zip

- Loan to Value Ratio

- Email Address (if selected and where available)

- Other Demographics, if selected

What types of businesses could benefit from knowing a Homeowner’s Loan to Value Ratio?

Any mortgage related business, like banks or lenders, can benefit from marketing to Homeowners who have a certain Loan to Value Ratio:

- Banks

- Credit Unions

- Loan Officers

- Mortgage Marketers

- Insurance Providers

- Refinance Opportunities

- Credit Card Companies

- Home Improvement Loans

Can I get a list of Homeowners who have a low Loan to Value Ratio?

Yes! We can help you reach Homeowners who have a low Loan to Value Ratio. Homeowners who have a low Loan to Value Ratio, and who have paid off a large percentage of their mortgage balance, are often perfect candidates for:

- New Mortgages

- Home Loans

- Insurance Offers

- Home Improvement Loans

- Home Equity Loans

What other mortgage information can we include on our list?

- Mortgage Amount

- Purchase Price

- Estimated Home Value

- New / Resale

- Loan Type

- Purchase Deed Date

Can I get Email Addresses on my List?

Yes! You can Buy Email Lists with email addresses.

How accurate are your Mortgage Mailing Lists?

We take great pride and care in the quality of our data so you can rest assured that you’re getting quality, up-to-date information.

Our data team constantly checks, tests & cleans our data; therefore, our Customers can enjoy the highest accuracy and deliverability rates in the industry.

Names + Mailing Addresses are 95+% accurate and are updated daily.

Consumer Email Addresses are 90+% accurate and 100% Opt-In.

Testimonials

Mortgage Mailing Lists With Loan To Value Ratios FAQs

[Q]Is the loan to value ratio indicative of the wealth of the homeowner?[A]Yes it is because it helps to identify how much equity is left in the home.

[Q]Does the loan to value calculation identify how much a homeowner can borrow on their home?[A]Yes it does.

[Q]Can I choose other demographics for a mailing list with loan to value ratios?[A]Yes you can. It makes no difference to the price of the list. You can have as many geographic and demographic selects as you need.